cares act stimulus check tax implications

Thanks to the CARES Act over 80 million Americans got a stimulus check. At this point in 2022 the stimulus check story is actually proceeding down two tracks.

Interactive Map New Data On 2020 Cares Act Stimulus Checks Penn Wharton Budget Model

The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and.

. The CARES Act may also have substantial state and local tax implications including the creation of additional refund opportunities related to previously. The CARES Act sends a 1200 stimulus check to eligible adults earning up to 75000. If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return.

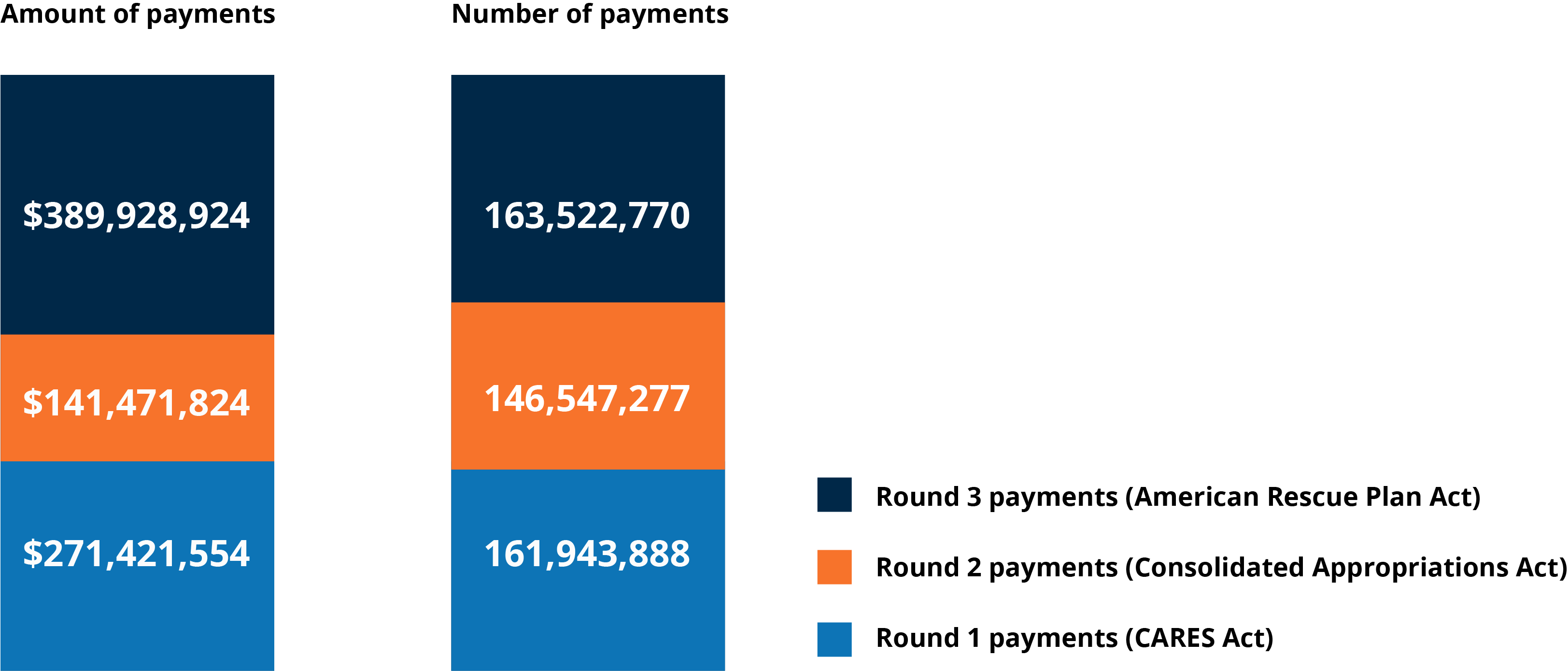

Out of those 159 million payments 120 were sent via direct deposit 35 million by check and 4 million by pre-paid debit cards. An EIP2 payment 23 de jun. The 22 trillion stimulus package includes measures to help businesses hurt by the pandemic as well as direct payments to citizens who have been hurt by the pandemic.

Tax Implications Of The 2020 Stimulus Check And CARES Act. Check out our Stimulus Check Calculator. Check our CARES Act Resource Page regularly for updates.

CARES Act Provides Tax Incentives for Charitable Giving in 2020. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the temporary window which is the period of time beginning with the. Another key provision is prescription drug pricing reform.

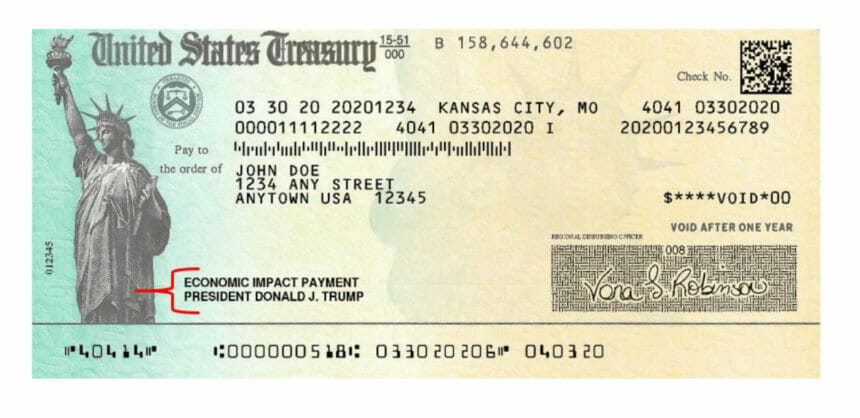

Permanent credits given to forgive overdrawn balances for clients receiving stimulus checks into an account with a negative balance of 50 or less. Key Cares Credits. The CARES Act provides eligible individuals with a refund check equal to 1200 2400 for joint filers plus 500 per qualifying child.

Net Operating Losses NOLs Changes the current tax law to permit a business with additional rules for pass-throughs to apply an NOL from tax years beginning in 2018 2019 or 2020 to be carried back for five years. The first one to note is the obvious one the one everybody is interested in. It also allocates 64 billion to extend an Affordable Care Act program to reduce insurance costs.

The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few. But what are the tax implications for stimulus checks and unemployment benefits. According to an HR Block study of small business owners fewer than 1 in 3 28 are confident that they understand the financial andor tax implications of receiving aid as a.

If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. It entails the possibility. On March 25 2020 Congress unanimously passed an economic stimulus package that allows for taxpayers to receive stimulus checks of up to 1200 per adult.

Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the. Prior to this change NOLs could.

Tax implications of other benefits from the CARES Act. The bill would empower Medicare to. On April 11 2020 the IRS began its first wave of payments.

For individuals who itemize their tax returns lawmakers extended a provision that allowed individuals to deduct qualifying medical expenses that exceeded 75 of their adjusted gross income. Taxpayers who have filed tax returns for 2018 or 2019 and who have authorized direct deposit started receiving their stimulus payments which are formally called. The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few.

A fourth stimulus check is being made available at the beginning of the new year. Check out our Stimulus Check Calculator. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

This Act combined with the CARES Act allows for mandatory and optional retirement plan changes. The Coronavirus Aid Relief and Economic Security CARES Act was signed into law by President Trump on 32720. The CARES Act may also have substantial state and local tax implications including the creation of additional refund opportunities related to previously filed returns or for.

Cares act stimulus check tax implications Friday March 18 2022 Edit. The refund begins to phase out if the individuals adjusted gross income AGI exceeds 75000 150000 for joint filers and 112500 for head of household filers. The IRS has stated that 159 million stimulus checks have been processed in the past two months totaling almost 267 billion.

Parents also receive 500 for each qualifying child child must qualify for Child Tax Credit. 30-day temporary credit provided to clients receiving stimulus checks into an account with a negative balance of greater than 50 to allow full access to the. New York State tax implications of recent federal COVID relief.

But evaluating these tax impacts can be daunting. Non-filers have until October 15 to claim their payments The IRS. Here we outline 5 major tax implications that have stemmed from the new stimulus package.

The 1400 payment is a part of the Biden administrations new American Rescue Plan which hopes to help individuals impacted by COVID-19 and other economic factors.

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Incarcerated Are Entitled To Stimulus Checks Federal Judge Rules Again The Washington Post

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Ftc Warns That Assisted Living Communities Cannot Take Residents Stimulus Checks News Mcknight S Senior Living

Stimulus Checks And Child Support King Law

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Three Rounds Of Stimulus Checks See How Many Went Out And For How Much Pandemic Oversight

Ftc Warns That Assisted Living Communities Cannot Take Residents Stimulus Checks News Mcknight S Senior Living

All You Need To Know About Round Two Of Covid Related Stimulus Checks

Everything You Need To Know About The New Coronavirus Stimulus Checks

How College Students Can Get Stimulus Money The Washington Post

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Track Your Stimulus Check Connecticut House Democrats

Impact Of The Coronavirus Stimulus Checks On The Economy Julian Samora Research Institute Michigan State University