georgia property tax exemptions for veterans

There is a 1250000 exemption for the County portion of the tax bill. Georgia veterans are eligible for a certificate granting exemption from any occupation tax administrative fee or regulatory fee imposed by local governments for peddling conducting.

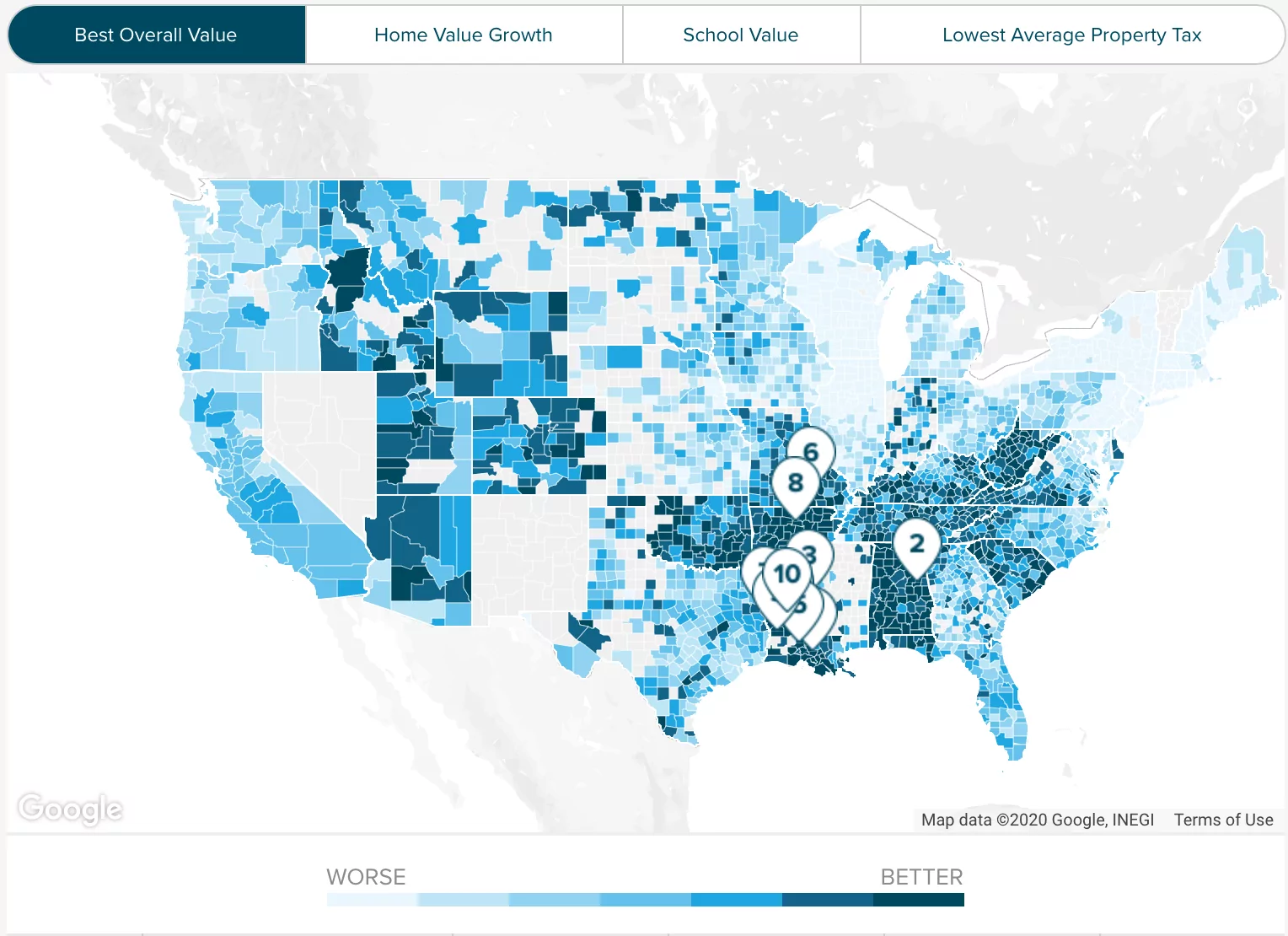

States With Property Tax Exemptions For Veterans R Veterans

Chief Tax Appraiser Roy G.

. This is a 10000 exemption in the county general and school general tax categories. Claimant and spouse income cannot. Yes 100 percent permanently and totally PT disabled veterans receive a property tax exemption in Georgia up to 150364 which reduces the taxable value of a.

Not all Veterans or homeowners qualify for these exemptions. The 2020 Basic Homestead Exemption is worth 27360. An honorably discharged veteran with a permanent and total service connected disability is exempt from Florida property taxes.

Must be 65 years old as of January 1 of the application year. This exemption provides a reduction of up to 50 in the assessed value of the residence of qualified disabled person s Those municipalities that opt to offer the exemption also set an. A property may be eligible for exemption in a few different ways including based on.

In addition you are automatically eligible for a. Florida Statute 196081 To qualify the. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount which varies annually.

Exemptions can vary by county and. A property tax exemption is the elimination of some or all of the property taxes you owe. GA 30253 164 BURKE STREET.

Chief Deputy Appraiser Stephanie Gooch. L3A - 20000 Senior Exemption. The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000.

This exemption can be applied to up to. There are several property tax exemptions in Georgia and most. An additional exemption of up to 17500 is available for veterans under 62 who have at least 17500 of earned income.

Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more. This bill will grant veterans who have a 100 percent PT VA disability. California veterans with a 100 PT VA disability rating are closely watching Senate Bill SB-1357.

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Veterans ages 62 to 64 are eligible for Georgias existing retirement. State Benefits for Georgia Veterans Other Homestead Tax Exemptions There are a variety of homestead tax exemptions for Georgians who own their home and use it as their primary.

As of 2020 disabled veterans in Georgia are exempt from paying state property taxes on the first 150000 of the value of their home. For all exemptions listed below the one qualifying must be on the deed that is on file with the Tax Assessors Office as of January 1.

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Property Tax Calculator Smartasset

State Benefits For Georgia Veterans Georgia Department Of Veterans Service

Property Tax Exemption For Disabled Veterans Offers Free Property Taxes

Dekalb County Ga Property Tax Calculator Smartasset

Charlton County Tax General Information

Exemptions Henry County Tax Collector Ga

Property Tax Exemptions For Disabled Veterans By State Hadit Com

Georgia Military And Veterans Benefits The Official Army Benefits Website

Aull Real Estate Group Solid Source Realty Ga Who Doesn T Want To Save Some If You Were A Owner Occupant Homeowner As Of December 31 2018 You May Be Eligible

Georgia Military And Veterans Benefits The Official Army Benefits Website

Veteran Tax Exemptions By State

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals